Retirement income is just about the most seriously considered topic on the planet today. How do I understand? Just because 78 million babyboomers may switch 65 this season. And since 65 used to be time to consign along and pleasing work life to the corner, the recession has set paid into a lot of plans. Listed below are 3 simple ways to get ready for your retirement time if retirement income is on your mind today.

Places around the world have moved retirement goal posts, as well as the classic age of 65 will simply indicate a fresh work era for many's beginning. Sadly for the baby boom era, the requirement to correctly estimate their retirement income was not understood by savers and the effect continues to be poorly assumed-out, programs that are shambolic ravaged by economy and moment.

Whatever your age, a better outcome will be currently guaranteed by working out a remedy than leaving things to chance. Thus, what are your alternatives? Listed below are 3 easy methods to plan your retirement time.

1) Evaluate your needs. What will your retirement period seem like? Does it include understanding period along with your favorite activity or sport, new designs, jetting round the world to see your children? Is there the excitement of learning new skills, putting them to workin your own personal organization? Or does one merely wish for a lifestyle of convenience? Taking the time to sort out the kind of life you want today ensures that you work and can prepare towards your retirement time that is new in ease. Your options is likely to be not and by design automagically.

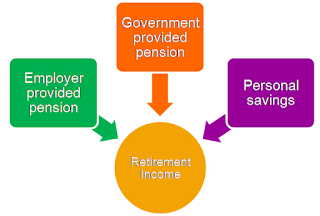

2) Study longterm pension prospects. By now, each and every babyboomer may have of what their retirement income appears like a concept. Pension estimates enable you to examine long-term where the spaces are leads and help discover. Having a long hard examine your living expenses that are possible can be a straightforward method to allow you to plan your new retirement time. In summary, do you want to have enough to cover-all your prices?

3) Match your retirement income for your goals. Does everything complement? If a weakness has been revealed by you, now's not the full time to panic. Now's enough time to plan forward so that if you get there, the job is completed. Take a look at the site here

What other straightforward tactics is there to prepare on your retirement time that is new?

Create saving for retirement important. Set to excellent use today.

Locate a part-time job. A shocking quantity of companies merely utilize parttimers (it's cheaper), so discover something perfectly foryou.

Start your own personal business. From the occasion you retire, and unknown business opportunities exist for those brave enough to test, you might have a well- oiled unit topping your pension up.